We know that consumers are increasingly demanding more of merchants for payments. It’s the main reason we created Vyne. We saw how legacy payment methods weren’t suited to modern day shoppers as they were slow and full of friction. We fixed those problems with Vyne’s account-to-account payments, powered by Open Banking.

Fast forward to today and it’s clear consumers demand further flexibility, such as spreading the cost of payments over time. Recent research has shown that 9.5 million British consumers now report that they avoid buying from retailers that don’t offer flexible payment options, risking poor conversion for merchants.

This is why we are thrilled to introduce Request with Vyne - our instalment payment solution.

What is Request with Vyne?

For merchants in many industries, payments are taken long before the customer receives the goods. Examples include ticketing for festivals and concerts, travel packages, preordered high value items and even furniture.

Request with Vyne allows merchants to split the cost of a purchase in instalments where a customer would typically need to wait to receive the goods.

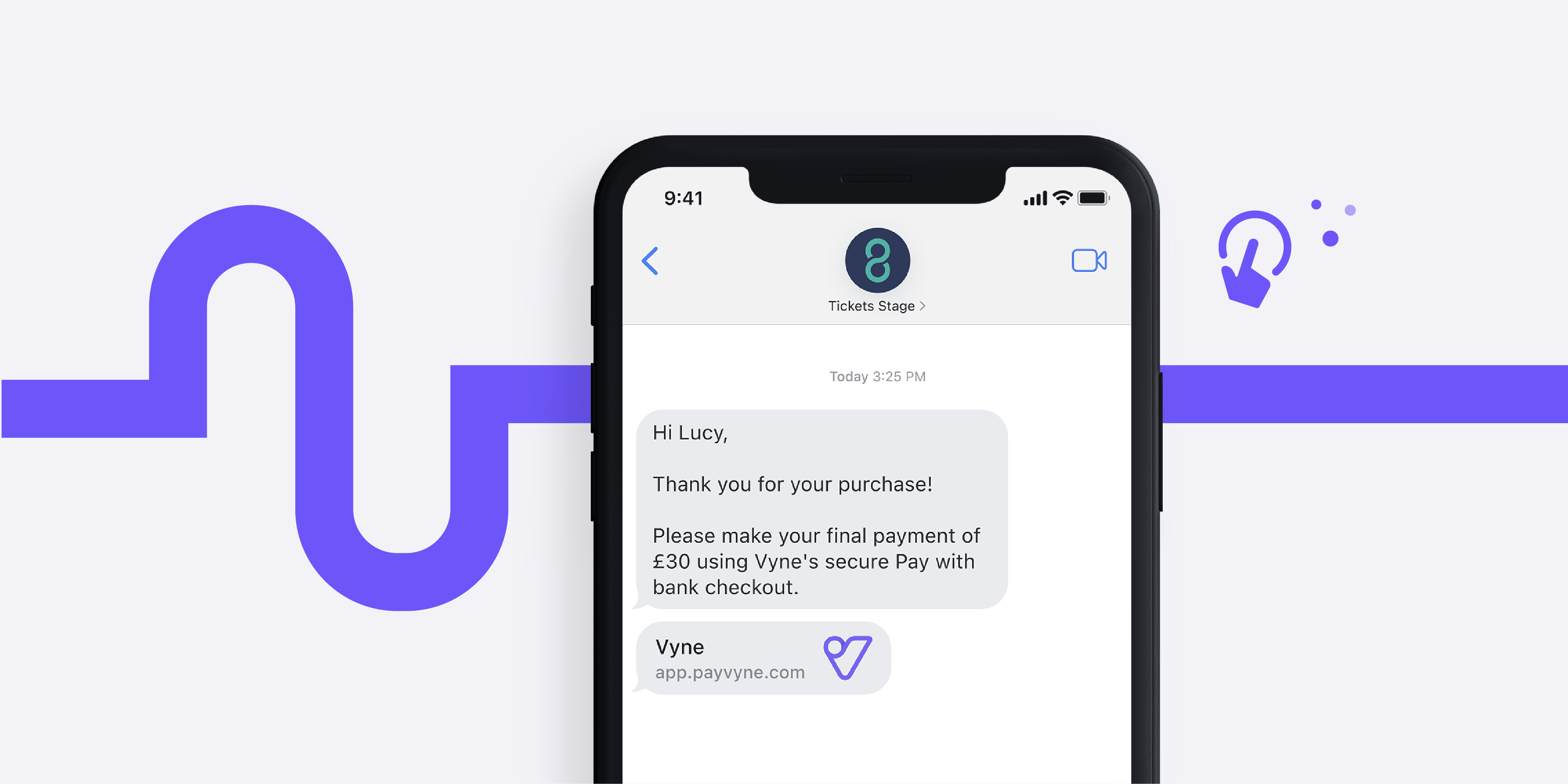

Merchants can generate a link to send to customers for them to pay their first instalment using Vyne’s fast and seamless payment checkout. That link is then sent to the customer as per the agreed schedule. This is completely flexible and makes it as simple as possible to pay for goods in advance.

How does it work?

We worked with Mainstage Festivals, promoters of high value, full-service package festivals to offer this very solution to their customers. Their customers had the choice of splitting the cost of their ticket in three instalments. As a result, a third of their customers opted to pay with Vyne, a figure they believe will rise to 60%.

“Vyne helped us deliver an instalment payment option. We are now able to offer our customers a flexible payment option and create a better customer experience, whilst reducing the amount we’re spending on processing card payments.”

Request with Vyne is not a credit solution. Neither Vyne nor the merchant provides credit to consumers as instalment credit payment methods do. The consumer will be expected to pay 100% of the price of the product before receiving the goods. This is simply a flexible way to pay in advance, helping consumers spread the cost of payments over time.

What about VRPs?

Variable recurring payments (VRPs) are a fully flexible recurring payments method, running on Open Banking. There is a lot of discussion about them as many are very excited for them to arrive. However, as of May 2022, limited trials are going ahead with selected banks.

For merchants to offer a fully widespread variable recurring payment option to their customers, the market needs working APIs across many banks. It is not expected that this solution will be fully available for a little while.

In the meantime, we have Request with Vyne which still allows you to benefit from lower transaction costs, instant settlement and improved conversion.